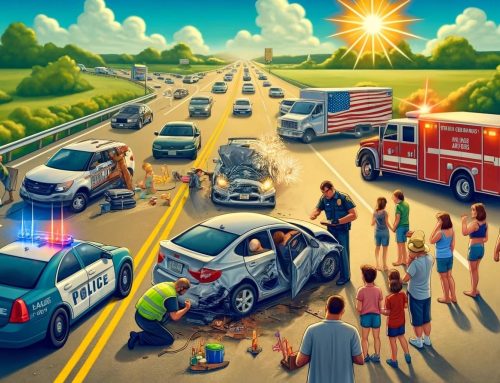

Many motorists choose the bare minimum amount of coverage when it comes to auto insurance in order to reduce monthly charges. However, if a significant accident occurs, this might make them vulnerable. Any car insurance policy should have comprehensive insurance coverage because it offers protection against a variety of conceivable risks.

The damage to your car from causes other than collisions is covered by comprehensive coverage, commonly referred to as “other than collision” coverage. This can involve theft, vandalism, natural disaster damage, and other things. It’s crucial to remember that comprehensive insurance does not pay for damage caused by collisions with other cars. Collision coverage steps in at this point.

The fact that comprehensive coverage provides financial protection for your car in the case of an accident or another covered occurrence is one of its main advantages. Without this insurance, you would be responsible for covering the costs of fixing or replacing your car out of your own cash. This could put a heavy financial strain on you, especially if you get into a catastrophic accident.

The ability to reduce your risk of responsibility in the case of a covered incident is another advantage of comprehensive coverage. You can be responsible for any harm or injuries that ensue, for instance, if your car is stolen and used in a crime. You can be protected from this type of liability with comprehensive coverage.

It’s also important to remember that comprehensive insurance can support the preservation of your car’s value over time. Comprehensive coverage will reimburse you for the real cash value of your vehicle at the time of the loss if your car is a total loss as a result of an accident or another covered occurrence. This can assist you in replacing your car with one of comparable worth.

A skilled accident attorney at Tucker Law is aware of the value of having adequate insurance coverage to safeguard your assets and yourself while driving. Do not hesitate to contact us at 1-800-TuckerWins for a free consultation if you have been in an accident. Together, we will fight for your rights and make sure you get the compensation you are due.

In conclusion, comprehensive insurance is a crucial component of a car insurance plan since it helps shield you from liability while providing financial security for your car in the case of an accident or other covered occurrence.

It’s crucial to talk with your insurance agent and confirm that you have the appropriate coverage to safeguard your assets and yourself while driving.